Printable Independent Contractor 1099 Form by Edward Parker 21 Posts Related to Printable Independent Contractor 1099 Form Printable 1099 Form Independent Contractor Irs Form 1099 Independent Contractor Independent Contractor Form 1099 Pdf Independent Contractor Form 1099 1099 Form Independent Contractor Agreement Miscellaneous 1099 Form Independent ContractorForm Pros offers online generators for legal, tax, business & personal forms 132 W 36th Street, New York NYPrintable Independent Contractor 1099 Form Form 0014 SHARE ON Twitter Facebook Google 21 Posts Related to Printable Independent Contractor 1099 Form Printable 1099 Form Independent Contractor Irs Form 1099 Independent Contractor 1099 Tax Form Independent Contractor Independent Contractor Form 1099 Pdf Independent Contractor Form 1099 Independent

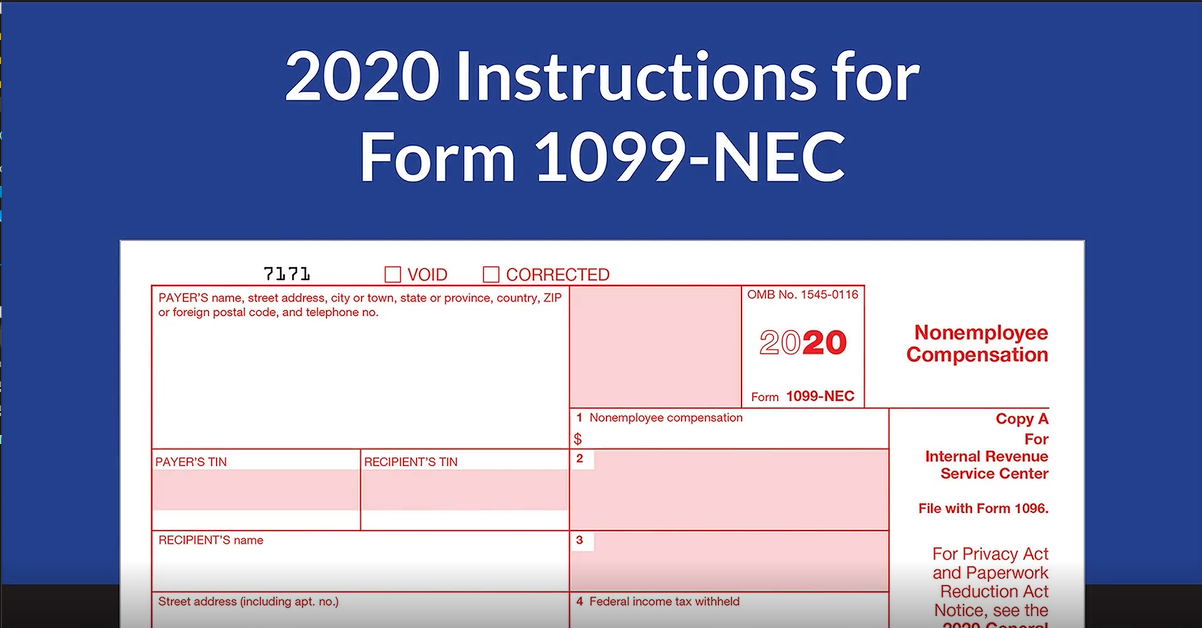

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

Printable independent contractor 1099 form

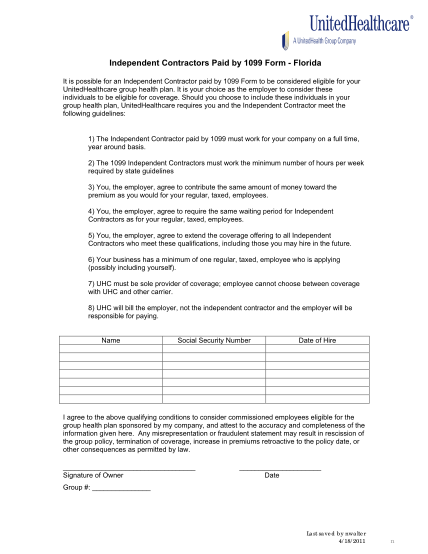

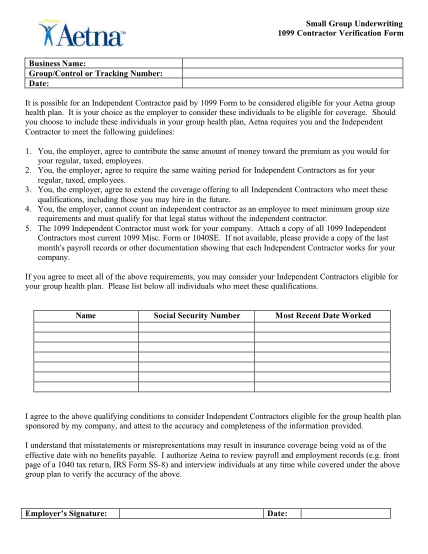

Printable independent contractor 1099 form-Printable Independent Contractor Agreement With 1099 Form – Most companies use the template with their newest contracts, but not everybody has one handy Most people prefer to make their own personal deal and get much more time to put together it than have somebody in addition undertake it for these people Form 1099 Types of Independent Contractors Did you pay an individual for performing work on a course of business?

Klauuuudia 1099 Misc Template

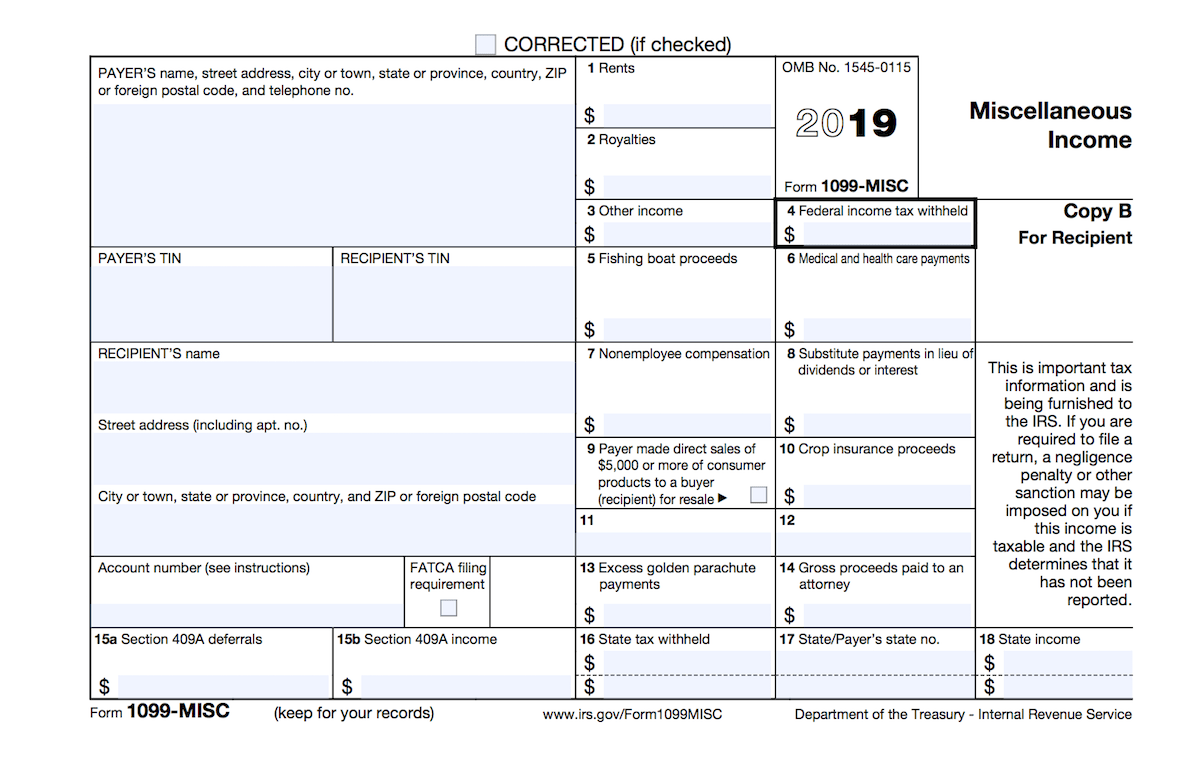

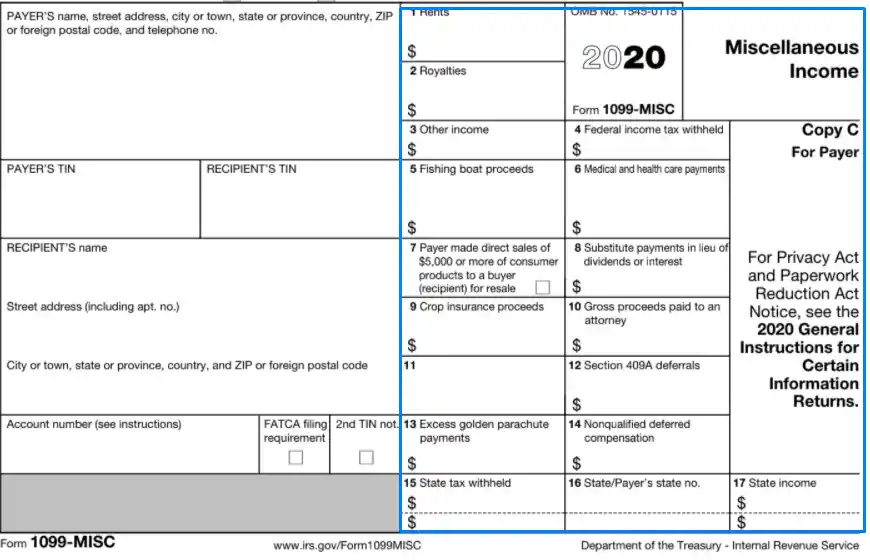

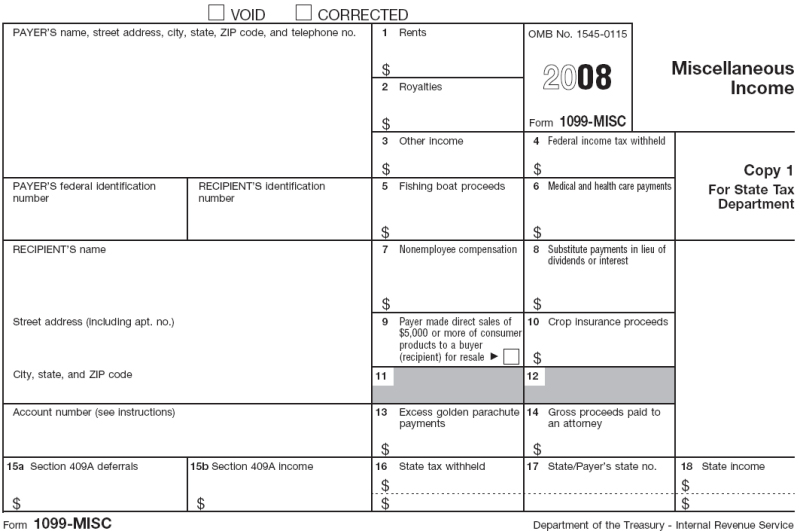

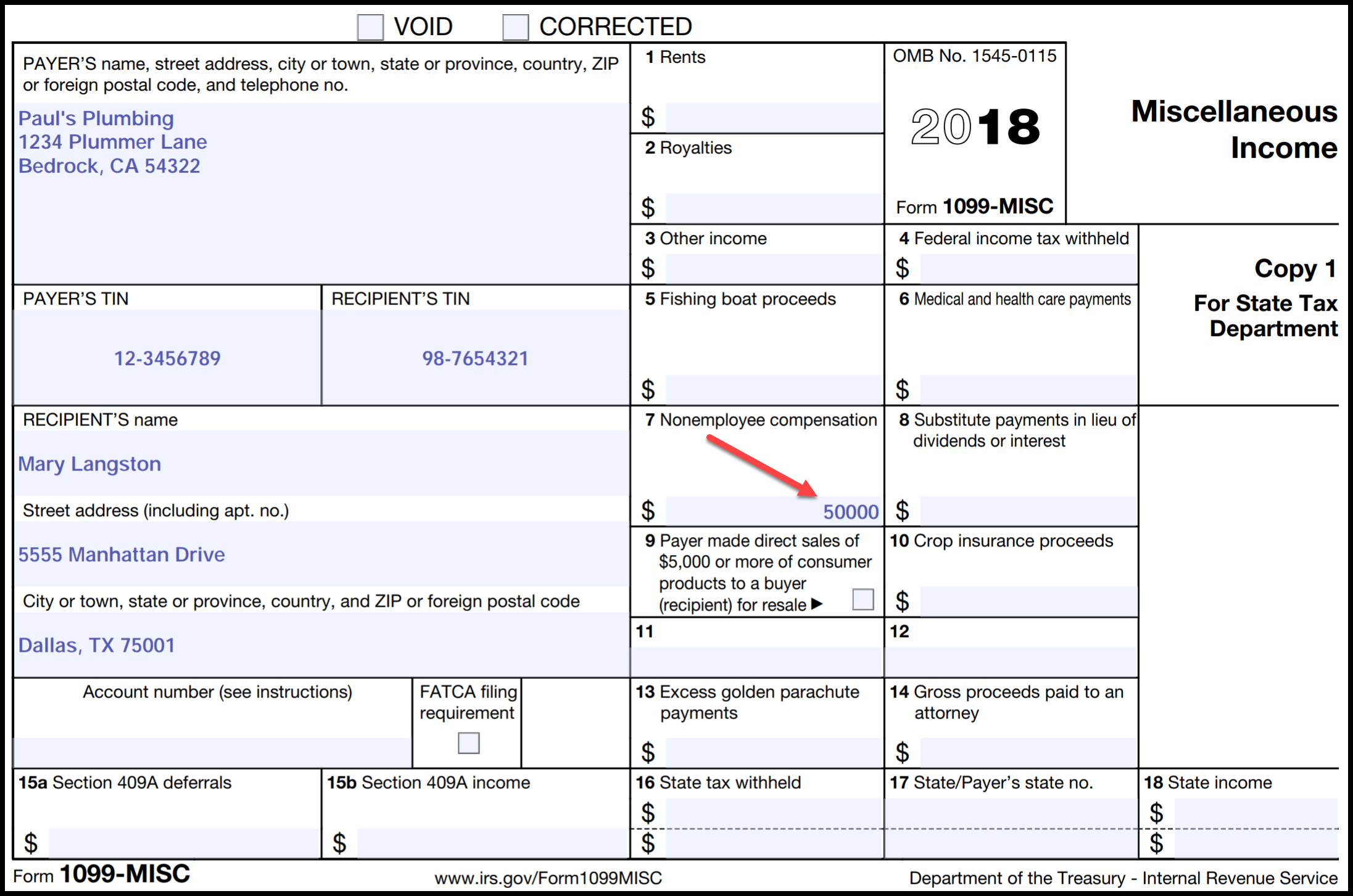

Printable 1099 Form Independent Contractor liaboehm Templates No Comments 21 posts related to Printable 1099 Form Independent Contractor Irs Form 1099 Independent Contractor Tax Form 1099 Independent Contractor 1099 Form Independent Contractor Agreement Independent Contractor Form 1099 Misc 1099 Form 15 Independent Contractor 1099 Form Independent ContractorGet Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee CompensIndependent Contractors and the 1099 If an employer has paid an independent contractor more than $600 in payments related to the business, then the employer will need to fill out an IRS Form 1099MISC This form will provide an income summary of all the employer's compensation that is not employee related This form will be what the IC uses

A list of job recommendations for the search printable 1099 forms independent contractorsis provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggestedDownload the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the1099 form independent contractor Complete forms electronically working with PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve documents using a legal electronic signature and share them by using email, fax or print them out download forms on your computer or mobile device Enhance your productivity with powerful

Irs 1099 Forms For Independent Contractors antoneruecker Templates No Comments 21 posts related to Irs 1099 Forms For Independent Contractors Free 1099 Forms For Independent Contractors Printable 1099 Forms For Independent Contractors 1099 Form For Independent Contractors 1099 Form For Independent Contractors 18 Sending 1099 Forms To ContractorsEmployees or Independent Contractor Use different forms 1099, W9, W4, W2 Oh my!> Printable 1099 Forms For Independent Contractors Printable 1099 Forms For Independent Contractors Form 0022 SHARE ON Twitter Facebook Google 21 Posts Related to Printable 1099 Forms For Independent Contractors Irs 1099 Forms For Independent Contractors Tax 1099 Forms For Independent Contractors Download 1099 Forms For Independent Contractors Free 1099 Forms

1099 Form 19 Online Tax Form 1099 Irs All Extensions To Print With Instructions

50 Free Independent Contractor Agreement Forms Templates

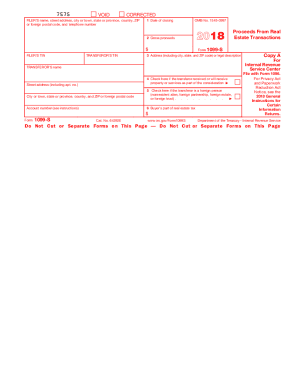

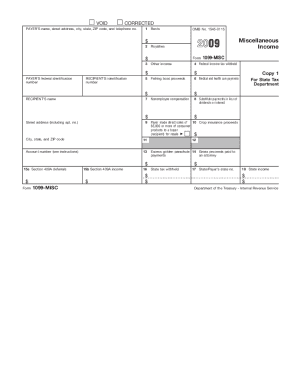

Tax form 1099 is generally used to report payments to nonemployees, such as independent contractors and freelancers It may also be used to show other kinds of payments, such as rental income or standby charges for a VOD payment Printable form 1099 blank should not be used to report wages paid to employees Federal form 1099 is used in cases when there is little information known about the recipient or when the amount of the payment is not subject to income tax withholding Free tax formIndependent Contractor 1099 MISC Form – In general, any business that has paid at least $600 to some individual or any unincorporated organization which has obtained at least two payment amounts from that person or business should problem a 1099 Form to every person or business that has received a minimum of one of these payment quantities This form is utilized by the IRSAn official website of the united states government the determination can be complex and depends on the facts and

1

1099 Form 19 Pdf Fillable

Click here to get Printable 1099 Forms For Independent Contractors to your pc Simply print the document or you can open it to your word application Some template may have the forms already filled, you have to delete it by yourselfIn the present scenario, business owners hire an individual to perform work on a contract basis If you paid the contractor, for performing service for trade or business You'll issue a 1099 Form 1099 FormPrintable 1099 Form Independent Contractor – One of the most significant and basic paperwork you have to have all the time is a 1099 form It's a form the IRS requires all companies to maintain It can be used by businesses as an efficient way of submitting their yearly income tax returns In this article I will clarify what a 1099 Form is, how you can get one, and what info it requires

Form 1099 Requirements

Form 1099 Nec Instructions And Tax Reporting Guide

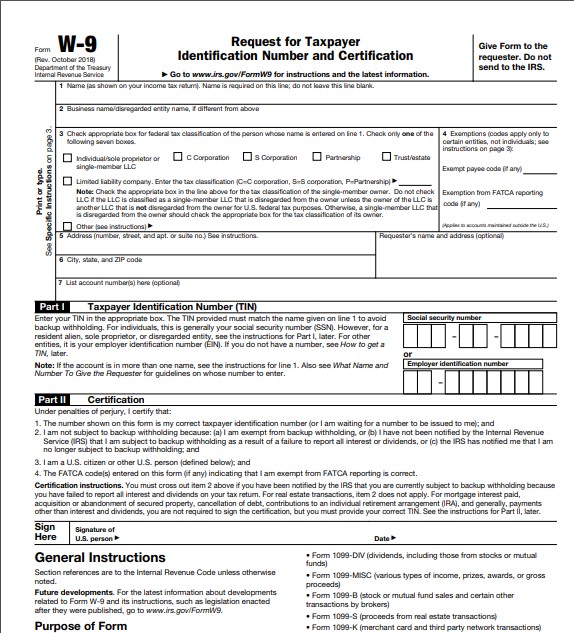

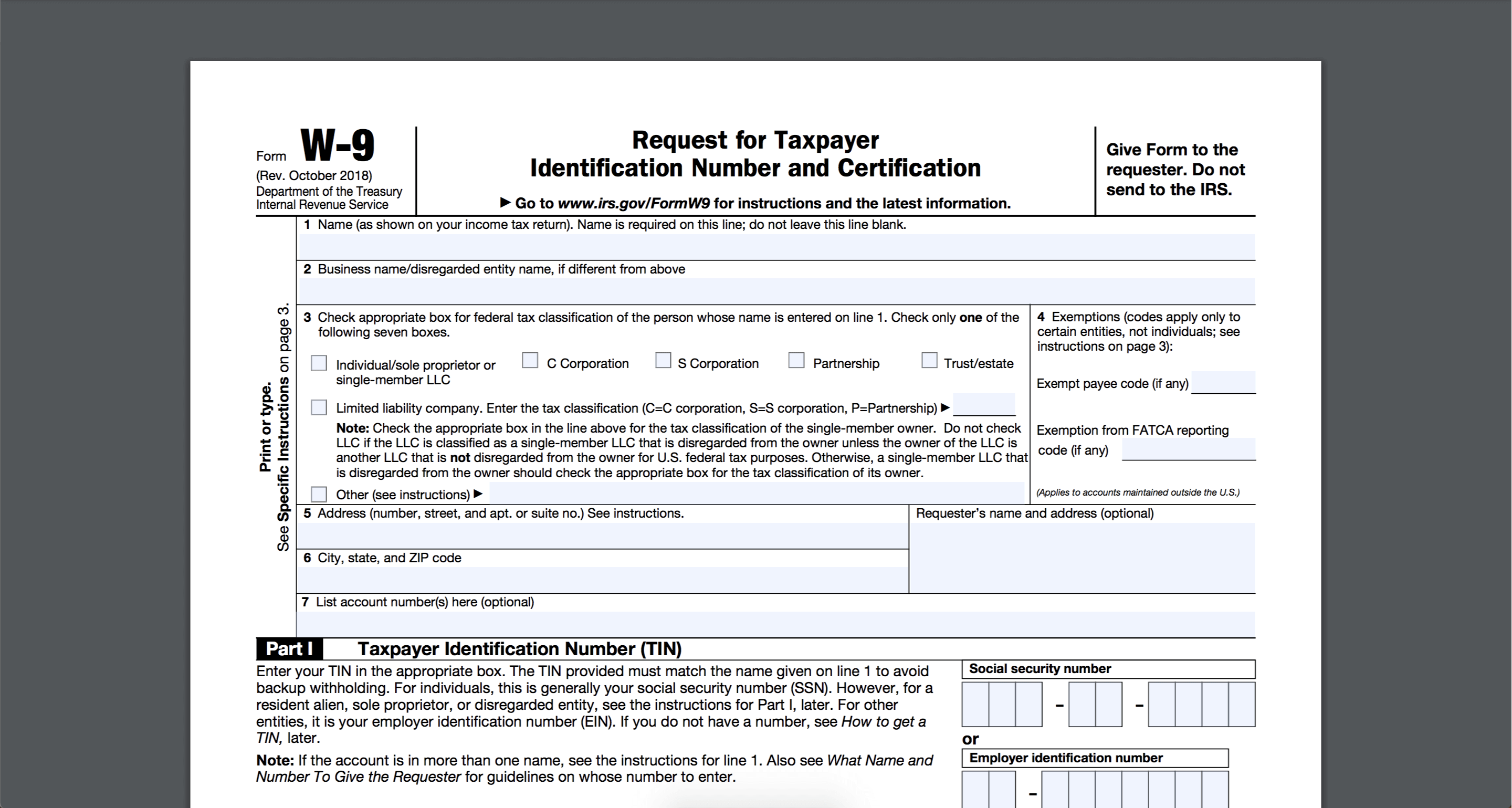

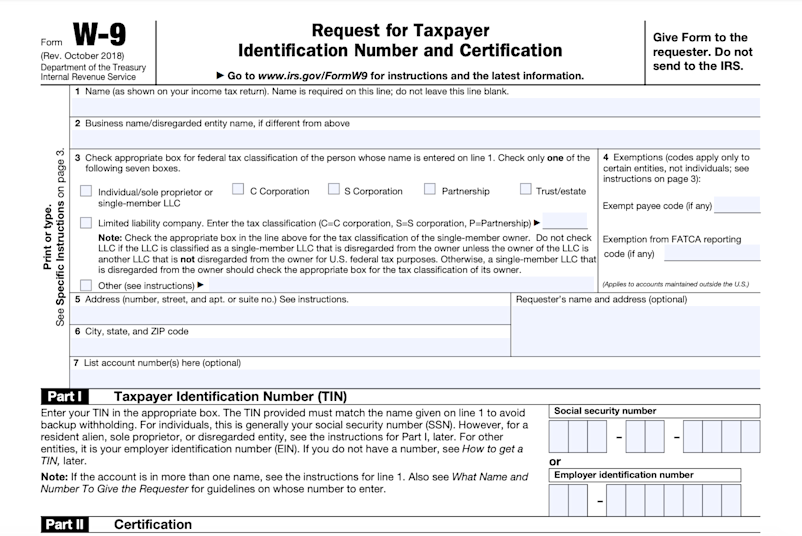

Fill in Blank Printable Invoice;Fha streamline worksheet 19; To allow this to happen in the first place, the independent contractor must submit a Form W9 so that their Form 1099MISC can be completed accurately If the independent contractor doesn't fill out and submit a Form W9, a portion of their income can be forwarded to the IRS by the payer This is because entities are required to report income paid to independent

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

1099 Nec Form 21 Get Irs Form 1099 Nec Instructions 1099 Misc Vs 1099 Nec Difference Printable Sample

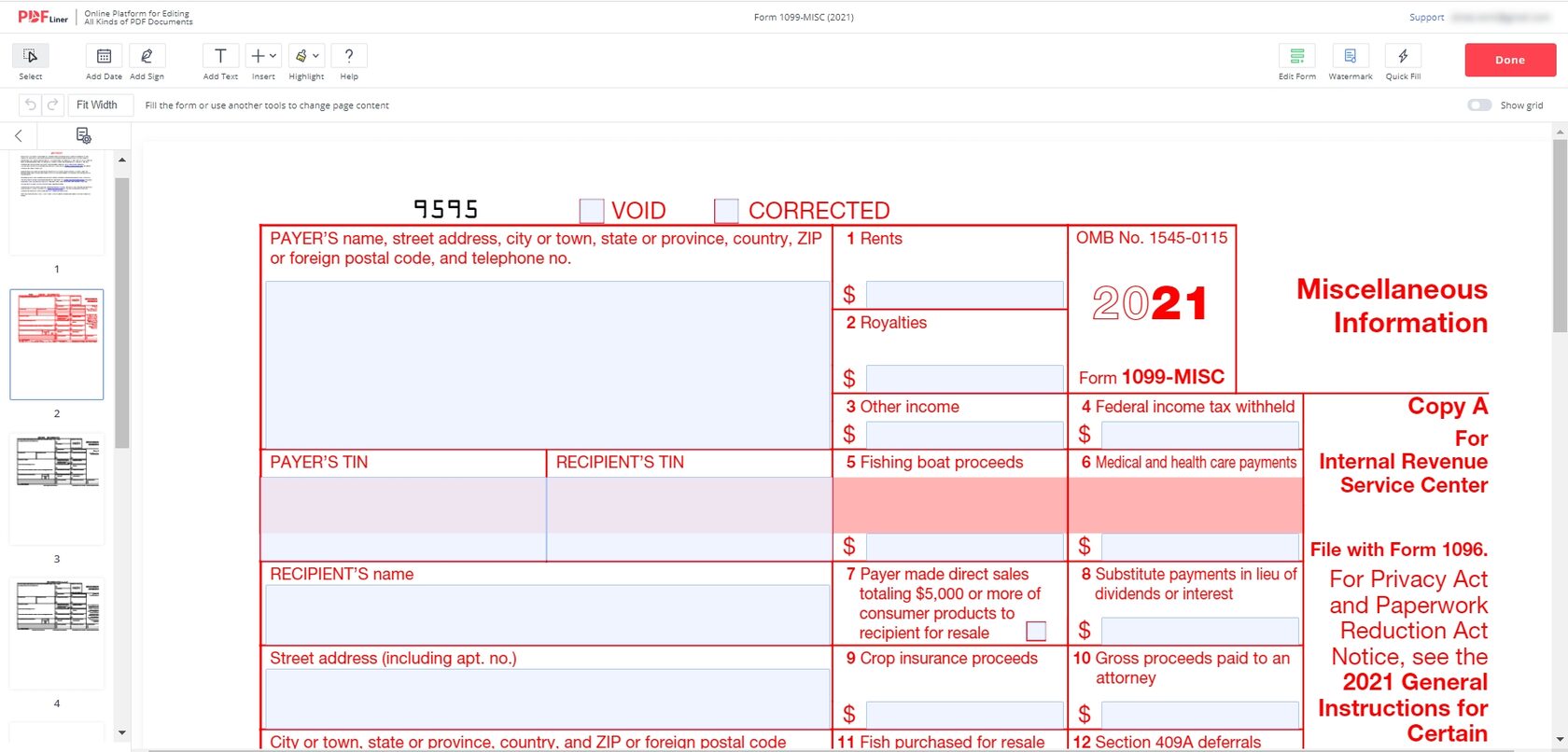

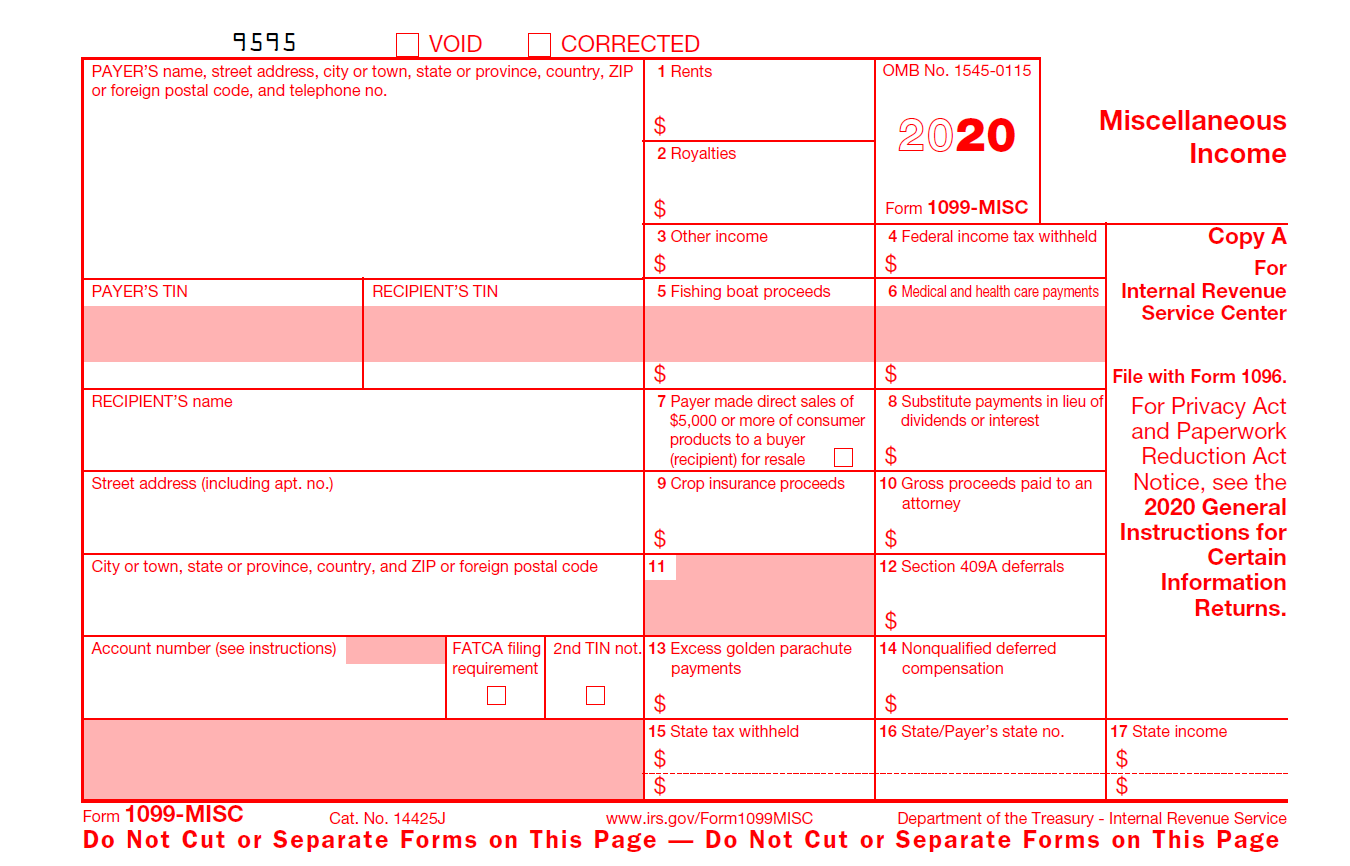

IRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the work 21 Posts Related to Printable 1099 Forms For Independent Contractors Irs 1099 Forms For Independent Contractors Tax 1099 Forms For Independent Contractors Download 1099 Forms For Independent Contractors Free 1099 Forms For Independent Contractors 1099 Form For Independent Contractors 1099 Form For Independent Contractors 18 1099 Form For Independent Contractors 19 Form 1099Employees and Independent Contractors have completely different forms to submit In a previous post, we talked about the differences between an employee and independent contractor Now, let's talk about the forms I get asked about these business forms, and the problem is I usually

Pin By Carole Pellegrino On Invoice Invoice Template Business Budget Template Invoice Template Word

Form 1099 K Wikipedia

Printable 1099 Form Download – A 1099 form reports certain kinds of income that the taxpayer earned over the year A 1099 is important since it's used to record the income that is earned outside of employment by a taxpayer Cash dividends, whether they're paid in exchange for holding stock, or interest earned from a bank account, a 1099 could be issuedFill in Blank Invoice PDF; > 1099 Form Independent Contractor Printable 1099 Form Independent Contractor Printable by Role Advertisement Advertisement 21 Gallery of 1099 Form Independent Contractor Printable Printable 1099 Form Independent Contractor Independent Contractor Printable 1099 Form Printable Independent Contractor 1099 Form Irs Form 1099 Independent Contractor 1099 Independent

What Is A 1099 Contractor With Pictures

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

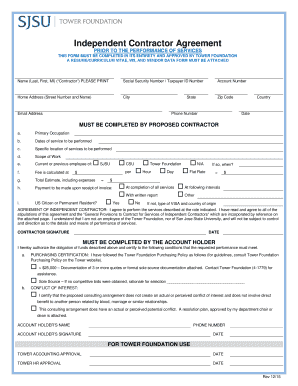

Payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,A 1099 form is a tax form used for independent contractors asset2 soup All pdf printa ble 1099 mis c ta x forms printable 1099 misc tax forms download printable 1099 misc tax forms create 14 printable 1099misc forms in pdf format to report income, 1099 employee compensation and rents to the irs during 15 taxIndependent Contractor is an independent contractor willing to provide certain skills and abilities to the Employer that the Employer has a demand and need In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Employer and Independent Contractor agree as follows 1 Work Status The Employer hereby employs the Independent Contractor as an independent

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

What Is A 1099 Form And Do I Need To File One River Iron

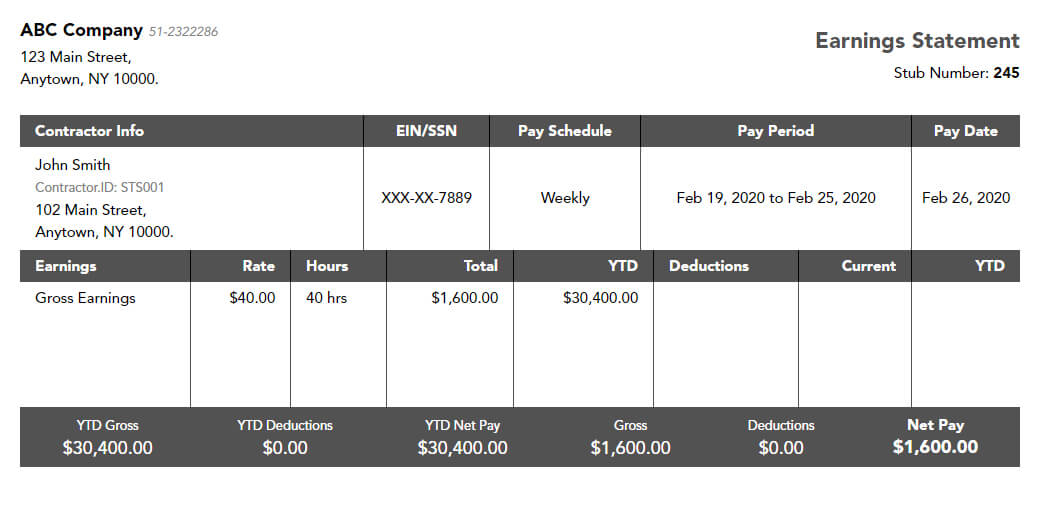

Which Form you'll issue to the individual?Printable independent contractor 1099 form Printable independent contractor 1099 formFor certain types of income other than employment, Form 1099 could be used to submit to the IRS dividends from stocks , or payments you receive as an independent contractor Businesses must issue 1099s to anyone who pays (other than a company ) thatThe taxpayers are supposed to send 1099 MISC Forms to the contractors by February 1st, 21 Submit your Form 1099 The primary tax form received by an independent contractor is Form 1099MISC If you performed work for a person or business as an independent contractor, you will receive this form at the same time that employees receive W2 forms They usually arrive around the end of January following the tax year You will need to receive a 1099 form only if you are paid over

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Get W 2 Forms And 1099 Misc Forms

Form W 9 Blank Fillable Printable Download For Free W 9 Instructions

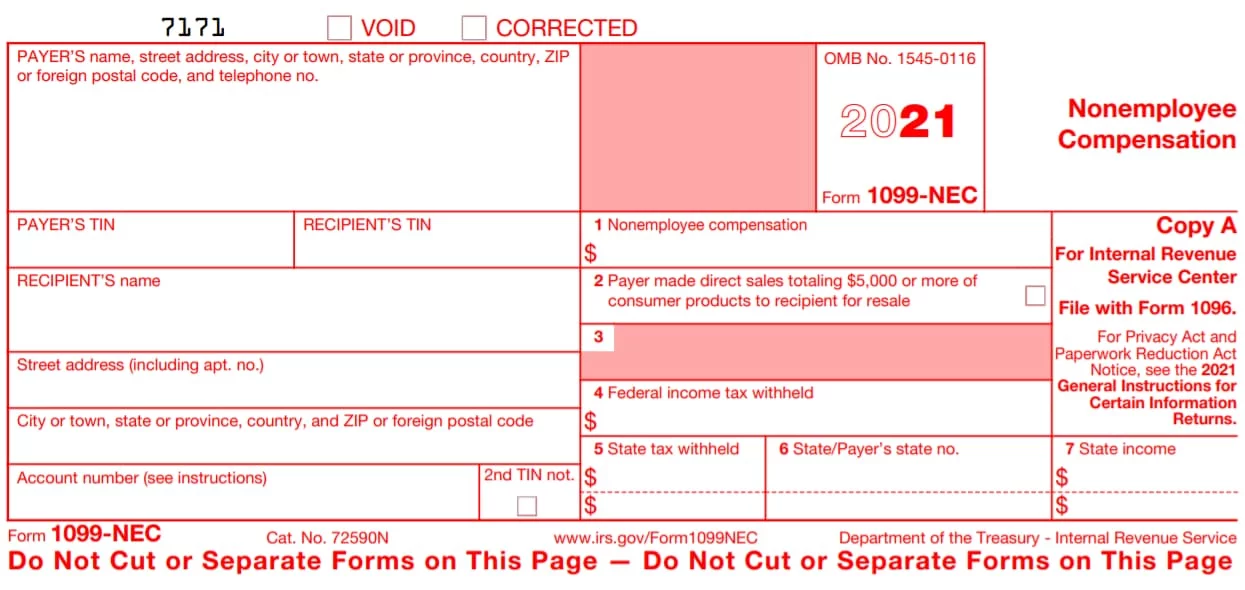

1099 form independent contractor 21 Fill out forms electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents by using a lawful electronic signature and share them via email, fax or print them out Save files on your laptop or mobile device Boost your productivity with effective solution!If you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to report how much income an independent contractor earns in a year You must send all completed 1099 forms to the IRS before January 31 of the following year1099MISC forms go to independent contractors, partnerships and other entities with whom you contract for services, among others The IRS has extensive

1099 Misc Form Fillable Printable Download Free Instructions

Pdf Forms Archive Pdfsimpli

Printable 1099 Form Independent Contractor by admin Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC) Report payment information to the IRS and the person or business that received the payment Get a W9 from Each Contractor The IRS form W9 is used to ensure you are contracting with a legal US person or entity It is a short form that includes name, contact, and tax ID information As a business owner bringing on an independent contractor, it is your responsibility to collect a form W9 and maintain a copy of it for future reference if needed

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

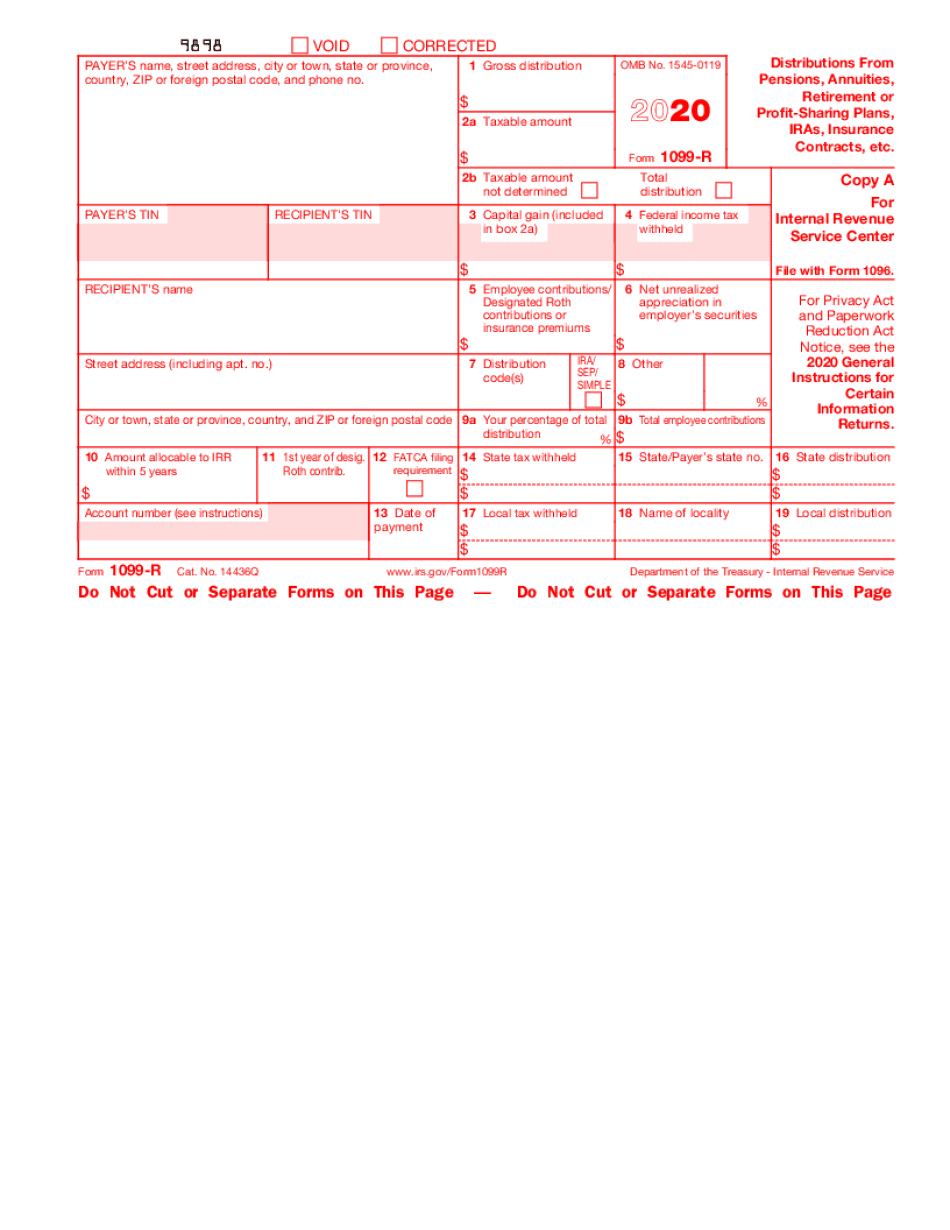

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1040ez form 19 printable;Free Printable Independent Contractor AgreementReal Estate Independent Contractor AgreementFree Printable Contractor ContractsREAD MORE HERE1099 form 19 printable;

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Form Fillable Printable Download Free Instructions

You can order these 1099 forms from our website by going to the 1099 forms page To print the 1099 form you send to the IRS select "Print data only on a preprinted Redink Laser form Copy A for Social Security on redink form" Please make sure you have preprinted 1099MISC in the printer before you hit the OK buttonFillable Form 1099MISC For Independent Contractor Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips In addition to the IRS forms that an independent contractor must file, their clients and employers are required to submit information regarding their transactions as well Any individuals or entities who have paid the independent contractor more than six hundred dollars ($600) within a tax year are required to file Form 1099 which details the transaction, as well as

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor

1099 Form Independent Contractor Pdf / Printable IRS Form 1099MISC for 15 (For Taxes To Be These can include deducting costs for your home office, vehicle expenses, advertising, continuing education, insurance pr How do i report this income?Fha streamline refinance worksheet 19;How to Download Printable 1099 Forms For Independent Contractors?

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Collect the required information about each independent contractor you hired during the last year Access your 1099 tax forms printable at our website Print the templates out or fill the forms online without having to do it manually Send a copy to each vendor you've hired before February 1st Don't forget to keep one copy for your own records — in case the Internal Revenue Service1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayerA 1099 or W2 Form?

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Create An Independent Contractor Agreement Download Print Pdf Word

Klauuuudia 1099 Misc Template

Irs 1099 Misc Form Free Download Create Fill And Print Wondershare Pdfelement

Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

Irs W9 Form 21 Printable W9 Form 21 Printable

1099 Forms Printable 1099 Forms 21 22 Blank 1099

Instant Form 1099 Generator Create 1099 Easily Form Pros

1099 Misc 14

Fillable Online Sjsu Independent Contractor Agreement Form Fax Email Print Pdffiller

1099 Form Independent Contractor Pdf Irs Form W 9 Fill Out Printable Pdf Forms Online

What Is A 1099 Misc Form And How To Fill Out For Irs Pdfliner

3

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

Free Independent Contractor Agreement Pdf Word

Form 1099 K Wikipedia

1099 Misc Form Fillable Printable Download Free Instructions

3

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Form 1099 Nec For Nonemployee Compensation H R Block

S Irs Forms Fill Out And Sign Printable Pdf Template Signnow

1099 Form Fill Out And Sign Printable Pdf Template Signnow

Form 1099 R Instructions Fill Online Printable Fillable Blank Form 1099r Com

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Form 1099 Nec Form Pros

1099 Form 21 Printable Free

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Software 1099 Printing Software 1099 Efile Software And 1099 Forms Software

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

1099 Form Irs Website

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

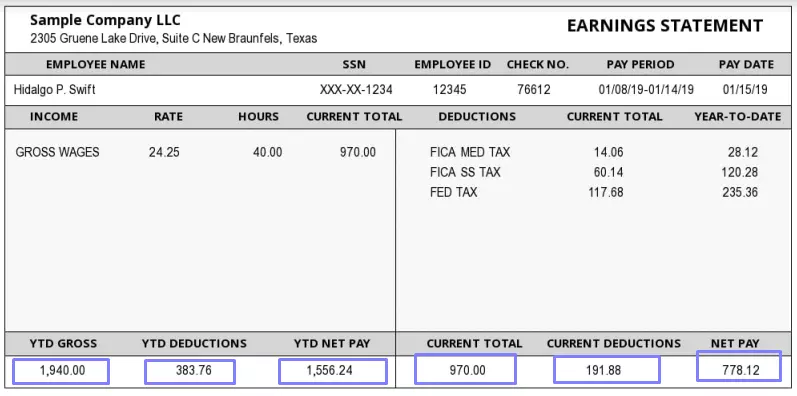

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Independent Contractor Pay Stub Template Fill Out Pdf Forms Online

Free Printable Independent Contractor Agreement Form Contract Construction Example

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

How To Fill Out And Sign Your W 9 Form Online To Get Paid Faster

1099 08

How To File 1099 Misc For Independent Contractor

W 9 Form 21 Fillable Printable

How To File 1099 Misc For Independent Contractor

Federal Income Tax Form Fast And Easy

Independent Contractor Paystub 1099 Pay Stub For Contractors

Payroll Forms Frequently Asked Questions And Links Office Of The Controller Wright State University

Fill Free Fillable Irs Pdf Forms

W9 Form 21 Printable Payroll Calendar

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Trucking Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Time To Submit W 2 And 1099 Forms Whitneysmith Company

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

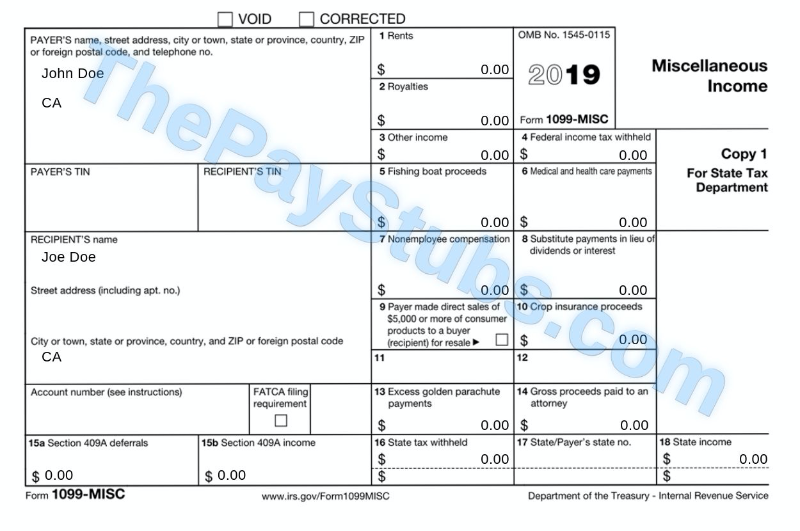

Fill Out A 1099 Misc Form Thepaystubs

Do I Need To File 1099s Deb Evans Tax Company

3

1099 Form Printable Get Irs Form 1099 Printable For In Pdf Fillable Blank Template 1099 Misc

1099 Form Fill Out And Sign Printable Pdf Template Signnow

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Free Independent Contractor Agreement Free To Print Save Download

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

2

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Online Irs Form 1099 Int 17 18 Irs Forms Irs Form

1099 Form Irs 18

What Is The Account Number On A 1099 Misc Form Workful

W 9 Form Fill Out The Irs W 9 Form Online For 19 Smallpdf

Get Your 1099 Miscs Right In 5 Easy Steps Cartwheel Technology Solutions For Business

Ready For The 1099 Nec Emc Financial Management Resources Llc

1099 Nec Form 22 1099 Forms Taxuni

Irs 1099 Misc 01 Fill And Sign Printable Template Online Us Legal Forms

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Misc Bhcb Pc

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

1099 Online No 1 1099 Generator Thepaystubs

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor

Irs Form 1099 Reporting For Small Business Owners In

0 件のコメント:

コメントを投稿